To view the full content of the report, please download the PDF below.

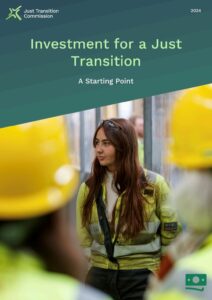

Investment for a Just Transition: A Starting Point

Overview

The Commission convened a roundtable in late 2023 bringing together key actors, organisations and decision-makers from the worlds of finance, policy, labour and civil society, groups that rarely meet in the same room. The objective was to define the core elements of the investment needs for Scotland’s just transition, take stock of existing investment models, and identify key challenges and opportunities.

This briefing sets out the challenge ahead for policymakers and financial institutions as well as the Commission’s key messages to the Scottish Government in developing plans to fund a just transition in Scotland. It distils findings and insights from the Commission’s roundtable as well as a record of the format and participants. The briefing also brings together an overview of a number of relevant initiatives across public and private sector. While most of these are at a relatively early stage in delivering against Scotland’s just transition investment requirements, they nonetheless provide positive signs of the kind of innovative activity that is needed on a larger and more co-ordinated scale.

The challenge

The Commission has previously identified a major investment gap in relation to Scotland’s just transition aspirations and the need for high quality investment of at least 2 per cent of GDP per annum to deliver these objectives (Making the Future: (2022)). This investment will be made by companies as well as financial institutions, by government bodies and agencies as well as by individuals and communities.

From a just transition perspective, how this investment is delivered will be critical: quality is as important as quantity in terms of access to finance, the cost of capital, the geographical location of investment as well as the environmental and social performance of the investment. Furthermore, like other sectors of the Scottish economy, our financial industry will need to be transformed to help support the equitable delivery of climate targets and ensure sectoral and regional just transition plans are supported with investment.

A critical step at this juncture is to establish a shared understanding of the current state of play in terms of existing investment models and the institutional landscape, to identify the changes that will be required, and the proper roles and responsibilities of public and private institutions if the policy priority of achieving a just transition is to be adequately funded. The Scottish Government’s just transition plans for key sectors provide a critical opportunity for leadership and co-ordination to move this agenda forward, provided the investment sections for each are adequately strategic, rigorous and detailed. A clear, high-quality prospectus for just transition investment has the potential to generate significant long term value for Scotland, including by making the most of opportunities to support the delivery of just transition outcomes presented by new initiatives at UK level, including the National Wealth Fund and Great British Energy.

Key messages

1. New and innovative investment models are needed. Scotland’s just transition will not be funded by the current approach.

The imperative of the just transition is being recognised by public and private financial institutions (for example in the Scottish National Investment Bank’s mission). But if investment provision is left to the market alone, we will see an unjust and ineffective transition. The just transition for Scotland is fundamentally about place and a key insight at the roundtable was that “international finance doesn’t care about place.” A different set of models, regulations, conditionalities and incentives is therefore urgently required so that public and private finance can combine to achieve long-term social and economic value, value that benefits communities and workers. Achieving a just transition will require the Scottish Government to take a proactive role in stimulating investment in the economy, nurturing new and emerging industries and scalable propositions, as well as becoming the driving force in co-ordinating efforts with local government and investors. Scotland’s financial sector could also develop distinctive capabilities in just transition investment, which could have international relevance. The Commission recently set out the need for an investment plan for the Grangemouth ecosystem; such plans will also be required for the North Sea transition and other high-emission areas of economic activity to safeguard the long-term future of workers and communities.

2. Finance for Net Zero is not the same as investment for a Just Transition.

Financial institutions in Scotland and across the world are making commitments to achieve net-zero portfolios. But work to get to this goal through a just transition is far less developed. The conflation of these related but separate objectives risks obscuring the specific elements of Scotland’s journey to a low carbon economy that will determine whether key changes are fair and equitable. Justice cannot be a second order consideration. To support public and private investment in a just transition, the Scottish Government’s plans for sectors and regions should set out a credible list of just transition investments aligned with strategic outcomes and approach to measuring their impact. These should in turn help form the building blocks to establish robust just transition pathways which complement the net zero pathways that have shown effective cut-through with investors and companies. The Scottish Government could use future bond issuance as a way to show how the just transition can come to life as part of its capital raising for the future.

3. It’s time for strategic clarity on roles and responsibilities.

Clarity and precision is required to define and map out strategic planning and public body delivery functions for just transition investment, including the Scottish Government (for example its Just Transition Fund), COSLA and enterprise agencies, the Scottish National Investment Bank as well as the UK Government, the UK Infrastructure Bank and the British Business Bank. The Scottish Government must take on primary responsibility for driving this agenda, via regular meetings and progress updates to track performance, flag risks and issues arising. This will help consolidate efforts that could otherwise be siloed, align expectations and support effective collaboration, and communicate key decisions and progress reporting across different portfolios and levels of government as well as the private and philanthropic sectors. Developing the appropriate investment plans for just transition will require extensive capacity and technical expertise. Just transition planning should therefore be established as a priority area of focus for the new Investment Strategy and Delivery Unit announced in the 2023-24 Programme for Government, providing direction to the Just Transition Unit as part of the whole-of-government approach to climate action and inclusive economic development.

4. Action is required to join up and leverage local capacity.

The place-based nature of the just transition means that a key risk in this area is a lack of local authority capacity, after many years of hollowing out of public sector capacity and skills. There is a clear need for a central strategic co-ordination function to provide join-up, leadership and support to local government, leveraging and expanding existing capacity to promote local leadership and provide requisite technical support. A key opportunity is the creation of coherent investment strategies for local government pension schemes geared towards just transition delivery. Alongside local authority leadership, a core feature of a successful just transition will be a thriving community ownership and investment sector for a variety of sectors and assets.

5. The cost of failure is unacceptable, given the scale of the opportunity for Scotland.

The short- and medium-term capital figures associated with achieving a just transition may look daunting in the current fiscal context. But investment planning at all levels of government must also factor in the cost of failure, whether in terms of adverse health outcomes, loss of ecosystem services, loss of jobs, loss of supply chain and manufacturing opportunities or the potential for many decades of lost growth and increased economic leakage. Short term “savings” will be hugely costly to Scotland if these ultimately stymie fair economic development at this critical juncture. Attention needs to be placed on the just transition outcomes that can be generated from a long-term green industrial policy, combining public, private and community resources.